What Moves You?

By R. S. Collins

Moving your office or perhaps opening a new one and not sure how to get started? Here are some tips to keep you on the right track.

That old real estate adage Location, Location, Location still holds true but I’d have to add Timing, Timing, Timing as equally, if not more important these days. When considering a location

there are many factors to consider. What’s driving the need for a new office? Are you looking for space that is more Client Centric or Employee Centric? Maybe you need to be closer to

your primary market or your looking for an amenity-rich area that will help you attract and retain quality employees. Combination of both may be a win-win. Give yourself plenty of

time to work through the process. Depending on your needs it can take months, not weeks to get a space prepared for move in. My typical client takes about eight months from identifying a

need for space to actually moving in. Obviously, this varies greatly, if you stumble upon a space that fits your needs right out of the gate the space no longer drives the timing. This is

a rare scenario. Once you find your space and have negotiated a lease the real fun begins. Design, Permit, Construction and tenant activities will determine the ultimate move date.

Short deadlines may have an adverse impact on your budget and quality.

Location drives costs. An amenity-rich area with good transportation tends to be higher priced than perhaps a suburban office park with ample parking but few amenities and weak

transportation options. One way to beat the cost and still wind up in that desired location is to look at older Class “B” office where the rents might be lower but you can still get a Class “A”

buildout. Often Landlords with an older building will offer favorable lease concessions to compete against new product. Lower rents and nice tenant improvement (TI) packages. “B”

rents with “A” buildout can be an appealing option.

Envision the “End Game” before you begin your search.

Determine Space and Budget Requirements:

Budget

Head Count

Future Growth

Office Intensive versus Open Plan

Conference Rooms

Training Rooms

Collaboration Areas

Game Room

War Room

Copy and Printing Needs

Storage

Kitchen

Security

Connectivity

Audio Visual Requirements

Power – Standard office verses special requirements which might include backup power

HVAC – Standard or enhanced for heavy heat loads such as a LAN Room or 24/7 operation

Access – Normal Business hours or 24/7

Lease Structure:

Full Service

Net

Industrial Gross

Term

Free Rent

Tenant Improvements

Turn Key or Allowance

The above list plays into how big the space needs to be and the building type, lease structure, and concessions. For example, a Flex Building’s rent will be net of certain costs such as

utilities and janitorial and adds in the prorated share of common area (CAM) expenses, taxes, and insurance. This has a lower base rent because it shifts certain costs directly to the

tenant. The flip side is it gives the tenant more control over access, HVAC systems, utilities and maintenance of your space. Full-service rates include a base year amount that captures

all the costs of operating the building. The tenant does pay for the year over year increases in the operating cost component of the rent but does not pay directly for utilities and common area

maintenance (CAM).

A Full-Service lease does not afford the tenant as much control. For instance, in most cases, the HVAC system does not operate outside of the normal business hours as defined within the

lease. If you require work after hours to get a proposal out you will have to schedule that time with the landlord and pay an hourly rate for the privilege of working late.

Typically, the longer the lease term the more favorable the concession package will be. Larger tenant improvement dollars, more free rent ectara. Most leases run in the 5 to

10-year term.

I’m not going to get into the different ways to measure space but to say there is a big difference based on the building and lease type being offered. For your needs, you should understand

the differences to enable a fair comparison of spaces. The basic terms are Rentable, Useable and Gross. Useable is just what it sounds like. The usable will determine if you fit or

not. The Rentable is what you pay rent on which includes common areas and amenities such as a fitness center accessible without membership to all the tenants. You should refer to my past

blog on “Understanding Core Factors and Why You Should Care”

Location Requirements:

Proximity to Restaurants

Shopping

Affordable Housing

Hotels

Walkability

Connectivity

Public Transportation

Parking

Proximity to Clients

Ease of Commute

Security

Rooftop Patio

Fitness Center

It is no secret, location is the biggest differentiator in determining rental rates. Identify the area you need to be in based on your employee and client drivers. I highly recommend

engaging a professional commercial real estate broker to help with your search. The broker knows the market, will arrange for tours, find the vacancies and understands the expectations of the

market, rent, concessions, and lease structure. A quality broker will be able to help you define your corporate needs and translate them into a building and lease structure that makes sense for

you.

Timing:

Current Lease Term

Understand holdover implications

Site Selection

Lease Negotiation

Design

Permit

Construction

Tenant Activities:

Furniture Procurement

IT Infrastructure

Internet and Phone Service

Suite Access Control

Move Coordination

Business Interruption

Copy and Printing Needs

There are lots of variables that can have a positive or negative impact on schedule, most of which will not be fully flushed out until you have

identified a site or at least developed your short list. Once the shortlist has been developed and existing conditions, market, and jurisdictional issues identified you can get a better handle

on design and construction schedule and costs. In some markets, the lead-time for just ordering your Primary Rate Interface (PRI) from your phone/internet provider can be up to 45 days.

If your choice of spaces requires construction the design process is 8 weeks and the permit process can be another 8 to 10 weeks or more. At this point, we are at 5 or 6 months and your

buildout has not started. 8 weeks for construction and now 8 months after starting the process you are ready to move in…… Whew! Time is not on your side, this typical schedule will be impacted

by the type of Lease, Size of Space, Design Elements, Long Lead Items such as HVAC, Special Finishes, Inspection and coordination of Tenant activities, your Business activities. You may be an

account that can’t move during tax season or a government contractor up against a proposal deadline.

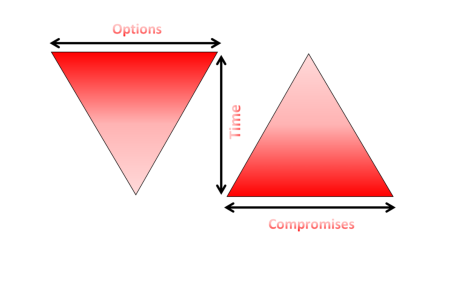

The above graphic is to illustrate the impact of timing on options. The shorter your timeframe the fewer and fewer options you have and the

greater the number of compromises you will make. A professional Project Manager (PM), well versed in Tenant relocations, will be an invaluable member of your team. The PM can greatly

assist with budgeting, lease negotiations, as they relate to tenant improvements, scheduling and the procurement and monitoring of the budget, schedule, design and construction services, permitting,

access control, furniture, IT Infrastructure, relocation services, and the very important quality control, just to name a few. A quality PM removes much of the day to day burden of planning and

monitoring a relocation so you can focus on your core business.

For more information on how we can help please call our offices at 571-207-6017, visit our website at www.rscpmc.com or email me directly at rsanders@rscpmc.com.